Navigating Car Insurance for First-Time Drivers

When you're a new driver, getting car insurance can seem like going into unknown lands. Knowing the steps and choices is very important to make sure you have enough protection without spending too much money. Lets dive into the details of getting car insurance if youre a first-time driver.

Understanding Car Insurance Basics

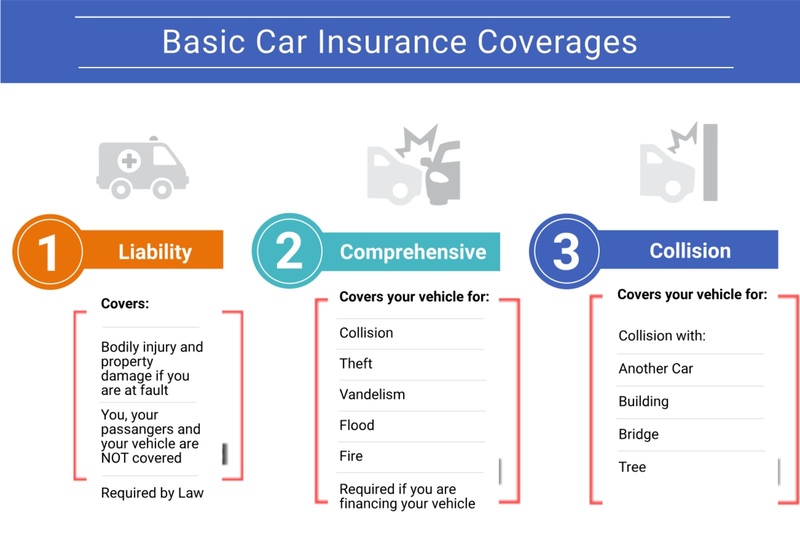

To begin, let us understand the fundamental parts of car insurance before taking a closer look. Normally, policies are made up of liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist (UM/UIM) protection. Each part has its role in safeguarding your financial stability if there is an accident or another covered eventuality.

Comprehending these parts is very important for verifying if your insurance is enough. Liability coverage, as mentioned before, looks after damages you make to other people's property or injuries suffered by others in an accident where you are at blame. Collision coverage takes care of damage to your car that happens when it hits another vehicle or object. The reason for the collision does not matter. It could be your mistake or someone else's fault. The third one, comprehensive coverage, gives protection to your vehicle from incidents like theft or damage caused by things other than a collision such as vandalism and natural disasters. Finally, if you have an accident with someone who doesn't have enough insurance or any at all, the insurance for uninsured/underinsured motorists will take care of it.

- Coverage Clarity: Be sure to understand the specifics of each type of coverage to ensure you're adequately protected in various scenarios.

- Legal Requirements: Familiarize yourself with your state's minimum car insurance requirements to avoid legal penalties or fines.

Factors Affecting Insurance Premiums

Insurance premiums for new drivers can differ a lot, and they depend on many things. The person's age, how much driving experience they have, the kind of vehicle being insured, where it is located and their driving history all affect the insurance premium. Premiums are usually higher for younger drivers or ones with less experience as they are seen to be at a greater risk.

Besides these, insurance companies also take into account your credit score - if it is higher, you might pay lower premiums because this indicates a likelihood of being more responsible with money. The number of claims made in your region can also affect the premium. If you live in a place where accidents or thefts happen often, your insurance expenses could be higher.

- Driver's Education: Completing a driver education course can not only make you a safer driver but also potentially lower your insurance premiums.

- Vehicle Safety Features: Vehicles equipped with advanced safety features such as anti-lock brakes, airbags, and anti-theft devices may qualify for discounts.

Choosing the Right Coverage

In the beginning stage of choosing car insurance, it is very important to think about the kind of coverage you want. Even though picking the minimum required coverage might look like a money-saving choice at first glance, it could result in more expenses from your pocket if there are accidents. Think about things such as how much your car is worth, how often you use it, and also your financial condition to decide what level of coverage will be suitable for you.

Apart from the lowest amount of coverage needed, you might want to buy more insurance for better protection. For instance, if your car is new or valuable then getting comprehensive coverage could give you extra financial safety in case it gets stolen or damaged without being involved in any collision. Moreover, having uninsured/underinsured motorist coverage can protect you if the person responsible for the accident does not have enough insurance to cover your expenses.

- Future Needs: Anticipate future needs such as adding additional drivers or purchasing a new vehicle when selecting your coverage to avoid gaps in protection.

- Financial Evaluation: Assess your financial situation to determine how much you can comfortably afford in deductibles and premiums without compromising your financial stability.

Comparing Insurance Quotes

As a new driver, it is very important to shop for insurance quotes because this will help you find the best rates. Get quotes from different insurers and make sure to compare what they offer in terms of coverage, deductibles, and premiums. Remember that the cheapest choice might not always give enough protection so focus on value more than price.

When you look at quotes, think about how good the customer service is from each insurer. If you read reviews or ask friends and family for suggestions, this can help give an idea of what kind of service different insurance companies provide. You might also consider how simple it is to file claims and how quickly the insurer responds when dealing with problems or answering questions.

- Policy Exclusions: Carefully review each policy's exclusions to ensure you understand what is not covered by your insurance in various situations.

- Customer Satisfaction: Research the reputation of each insurance company in terms of customer satisfaction and claims processing to ensure a smooth experience in case of an accident.

Taking Advantage of Discounts

Insurance companies might give discounts for the initial time drivers to lessen their insurance costs. These discounts may come from keeping up good grades, finishing driver education classes, setting up safety features on your car, or combining more than one policy such as auto and renters insurance. When you get quotes, remember to ask about available discounts.

Also, some insurance companies give loyalty discounts. These special price cuts go to customers who renew their policies for more than one year in a row with the same insurer. As time goes on, these discounts can add up to big savings and make it beneficial for you to keep a long-term connection with your insurer.

- Continuous Coverage: Maintaining continuous coverage with the same insurer can often lead to loyalty discounts over time.

- Annual Policy Review: Periodically review your policy to ensure you're taking advantage of all available discounts and adjust your coverage as needed to reflect any changes in your circumstances.

Considering Parental Policies

Sometimes, new drivers could stay on their parents' car insurance policies which might lead to lesser premiums. But this choice could not be there for all of them, especially if the person has left their parents' home or owns a vehicle. Talk about the chance with your mom and dad along with an insurance agent so that you can understand what is less costly.

For those who can remain on their parent's policy, it is crucial to keep in mind that your driving record and any accidents you have will affect the premiums they pay. You should also think about what might happen if you stay on their policy - like not having much say in certain coverage decisions or possibly facing higher premiums after an accident happens.

- Policy Ownership: Understand the implications of remaining on your parents' policy in terms of ownership and control over coverage decisions.

- Responsibility Sharing: Communicate openly with your parents about the financial implications of remaining on their policy and how any accidents or violations may affect their premiums.

Bottomline

Getting car insurance for the first time as a driver might look tough, but if you think and search well, it's possible to find the appropriate coverage that fits your requirements and budget. Keep in mind to review your insurance needs frequently as you get more driving practice and experience life alterations. This is important so that you can stay sufficiently protected on the road.