All You Need to Know About Money Supply and How It Affects You

The total amount of actual currency in existence throughout the country, as well as the funds kept in savings and checking accounts, make up the money supply in the United States. Other types of assets, such as investments that last a while, home equity, or tangible assets that need to be sold in order to be converted into cash, are not included. Furthermore, it excludes several kinds of credit, like credit cards, mortgages, and loans.

The Money Supply: What Is It?

To put it simply, the money supply refers to the total quantity of money that is accessible in an economy at any one moment. It's all the money, coins, and readily available deposits that people and companies may utilize for spending or saving; it's the equivalent of the financial "blood supply" of the economy.

The entire quantity of money in circulation in an economy, including checkable bank deposits and other liquid assets, is known as the money supply. The governing authority or the monetary authority of a nation controls the amount of money in circulation in the majority of economies worldwide.

What is the Impact of the Money Supply on the Economy?

When the money supply grows, interest rates are often lowered. This leads to more investment and money in the wallets of consumers, which in turn stimulates expenditure. In response, companies place larger orders for raw materials and boost output. The need for labor rises as a result of the increasing economic activity.

In the event that the money supply contracts or slows down, the reverse may happen. Bank lending decreases, companies postpone new initiatives, and buyer interest for auto and house loans falls.

It has long been believed that changes in the amount of cash supply have a significant role in determining business cycles and economic performance. Measuring the financial supply has historically shown that there are correlations between the amount of money in circulation and both inflation and price levels.

What Factors Affect the Money Supply?

Economists examine a variety of components included in the large amounts of M1 or M2 to ascertain how all that money is moving through the economy and where potential issues may exist. These elements are referred to by economists as the money supply determinants. Among them are:

- The ratio of monetary deposits. That is, the quantity of money that the general people do not deposit in banks but instead keep on hand.

- The ratio of reserves. This is the entire sum of cash that a bank must maintain in its safe deposit boxes to cover all of its clients' possible withdrawals, even in the case of a bank run. This requirement comes from the Federal Reserve.

Reasons Behind Changes in the Currency Supply

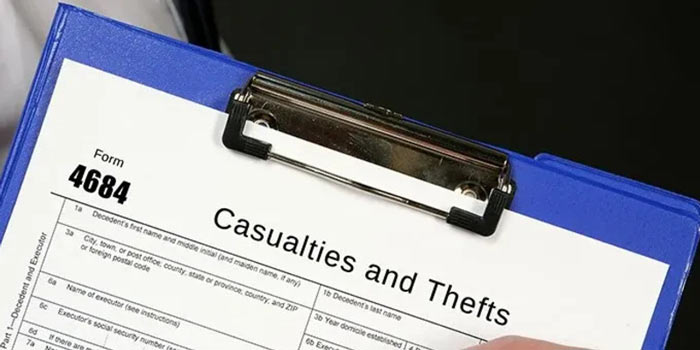

Three primary instruments are used by the Federal Reserve, which regulates the money supply, to induce a change in the supply of money curve. The reserve demand ratio, open market activities, and discount rate are some of these instruments.

A change in the slope of the money supply to the right lowers the rate of interest at equilibrium and expands the quantity of money throughout the economy while maintaining a steady level of money demand. Conversely, a leftward shift in the money supply would result in a decrease in the amount of money in the market and an increase in interest rates.

Reserve Requirement Ratio for Money Supply

The amount of money that banks must maintain in their reserves is referred to as the reserve requirement ratio. Banks are able to lend more money to their customers when the Federal Reserve reduces the amount of reserves they must maintain. The curve of cash supply is then moved to the right as a result.

However, banks are forced to hold more of their financial assets in reserves when the Fed retains a high resource requirement, which limits the amount of loans the banks are able to provide. The curve illustrating the money supply is shifted to the left as a result. When the money supply is restricted by the Federal Reserve, what happens? The macroeconomic profile of a nation is greatly influenced by its money supply, especially when it comes to interest rates, the rate of inflation, and the economy's cycle.

What Causes the Money Supply to Increase or Decline?

Think of a local bank as a miniature version of the national economy. Since the locals have been doing well recently, they've obtained greater funds to save. The bank receives it as a deposit. The majority of the deposits are lent to other people and companies by the bank, which retains a portion of them in a vault. The bank has additional cash to lend when the loans are returned with interest. The amount of cash on hand is growing, and the times are favorable.

However, what happens when things are not going well? When individuals are struggling to make ends meet or are in danger of losing their employment, bank deposits decline. The bank's lending capacity is reduced. In any event, the weak economy makes people and companies reluctant to make large purchases. There is less money in circulation.

The Bottom Line!

One of the topics in economics that is perhaps the most concrete and intelligible is the money supply. It is an accounting of all the money in circulation inside the United States economy. All of a person's money, from dollars and coins to the little change in their pockets.

The money supply is taken into consideration by the Federal Reserve for possible actions. Is it necessary to inject more funds into the financial system to promote more flexible spending, expenditures, and job creation? In order to prevent inflation, should it retreat and reduce the flow of funds through the system? Every month, on an extra Tuesday at one o'clock Eastern time, the Federal Reserve publishes its money supply statistics.