Navigating Property Taxes: A State and County Comparison

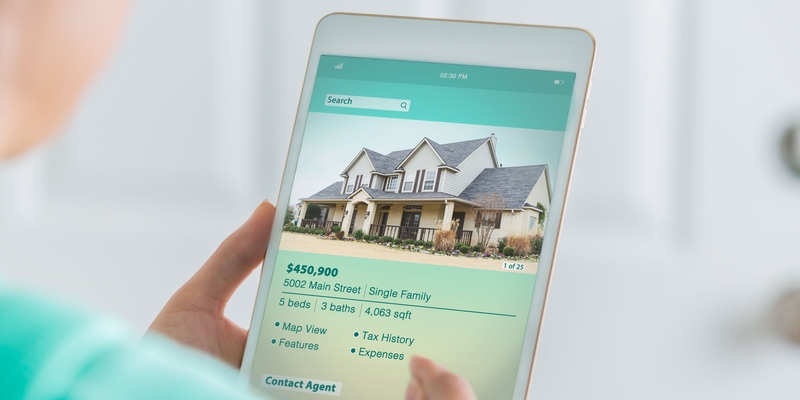

One inevitable financial burden that comes with owning a piece of the American dream is property taxes. Having a solid understanding of property taxes can greatly impact your financial planning, regardless of your experience level with real estate. In this article, we'll explore the highest and lowest property taxes by state and county, giving you a comprehensive look at how different regions stack up.

State Differences

When it comes to property taxes, each state has its own set of rules and rates. Some states have high property taxes due to various factors, such as high property values, while others have lower rates to attract homeowners.

New Jersey consistently ranks among the states with the highest property taxes, primarily due to its high property values and local government spending. The densely populated state boasts desirable locations near major cities like New York City and Philadelphia, driving up property values and, subsequently, property taxes. Additionally, New Jersey's extensive public services and infrastructure contribute to the need for higher tax revenues.

On the flip side, states like Hawaii and Alabama have relatively low property taxes, making them attractive options for budget-conscious homeowners. In Hawaii, the state's reliance on tourism revenue and relatively low population density contribute to lower property tax rates. Similarly, in Alabama, property taxes are kept low to encourage homeownership and stimulate economic growth.

County Variations

Within each state, property tax rates can vary significantly from one county to another. Factors such as local government spending, school funding, and infrastructure maintenance play a role in determining county-level property taxes.

In New York State, Westchester County has some of the highest property taxes in the country. As one of the wealthiest counties in the United States, Westchester boasts high property values, which translate into hefty tax bills for homeowners. The county's robust public school system and extensive public services also contribute to the need for higher tax revenues. Nearby counties like Putnam and Dutchess, while still affluent, have significantly lower property tax rates due to differences in local government spending and infrastructure needs.

Similarly, in Texas, property tax rates can vary widely depending on the county. Urban counties like Travis, which includes the city of Austin, may impose higher tax rates to fund essential services and infrastructure projects. Meanwhile, rural counties may keep tax rates relatively low to attract residents and stimulate economic development.

Factors Influencing Property Taxes

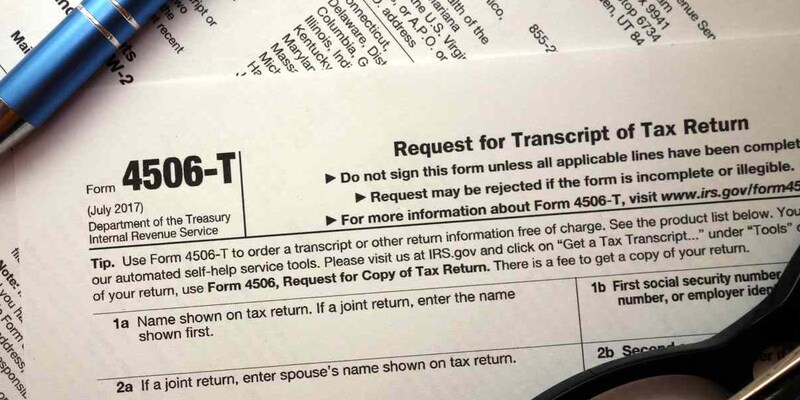

Several factors contribute to the calculation of property taxes, including property value, local tax rates, and assessment practices. Higher property values typically result in higher taxes, as the tax is calculated based on a percentage of the property's assessed value.

The county and municipal governments' local tax rates have a big influence on how much property taxes cost. These rates can vary widely depending on local spending priorities and revenue needs. For example, counties with extensive public services and infrastructure projects may need higher tax rates to fund these initiatives, while counties with lower spending needs may keep tax rates relatively low.

Additionally, assessment practices, such as how frequently properties are reassessed and how accurately they are valued, can impact property tax burdens. In some areas, properties may be reassessed annually based on market trends, ensuring that tax bills reflect current property values. In other areas, properties may be reassessed less frequently, leading to discrepancies between assessed values and market values.

Impact on Homeowners

The impact of property taxes on homeowners varies depending on individual circumstances. For some, property taxes represent a significant portion of their housing expenses, especially in areas with high tax rates.

In contrast, homeowners in areas with lower property taxes may have more disposable income to invest in their homes or save for other expenses. However, it's essential to consider property taxes alongside other factors such as home prices, income levels, and quality of public services when evaluating the overall affordability of homeownership in a particular area.

Strategies for Managing Property Taxes

Follow these strategies for managing your property taxes.

Understand Local Tax Laws and Assessment Practices

Before diving into property ownership, take the time to understand the local tax laws and assessment practices in your area. Familiarize yourself with how properties are valued and assessed, as well as any exemptions or deductions available to homeowners.

By understanding these nuances, you can ensure that your property is accurately assessed and that you're not overpaying on your tax bill.

Take Advantage of Available Exemptions and Deductions

Many states offer various exemptions and deductions that can help reduce your property tax burden. For example, look into homestead exemptions for primary residences, which can provide significant savings on property taxes. Additionally, seniors and veterans may qualify for additional tax relief programs, further lowering their tax bills.

Be sure to research and take advantage of any applicable exemptions and deductions to maximize your savings.

Stay Informed and Advocate for Fair Tax Policies

Stay proactive in monitoring proposed tax rate changes and participating in local government budget discussions. By staying informed and actively engaging with local officials, you can have a voice in shaping property tax policies.

Advocate for responsible spending and fair tax policies that benefit all residents, ensuring that property taxes remain equitable and affordable for homeowners in your community.

Conclusion

Property taxes are an inevitable part of homeownership, but they don't have to be a source of financial stress. By understanding how property taxes are calculated and comparing rates across different states and counties, homeowners can make great choices about where to buy and how to manage their tax burden.

Whether you're eyeing a home in a high-tax state or looking for ways to lower your property tax bill, knowledge is key to navigating the complexities of property taxation in the United States. With careful planning and strategic tax management, homeowners can minimize their tax burden and enjoy the benefits of homeownership without breaking the bank.