Understanding the Purpose of Form 4506

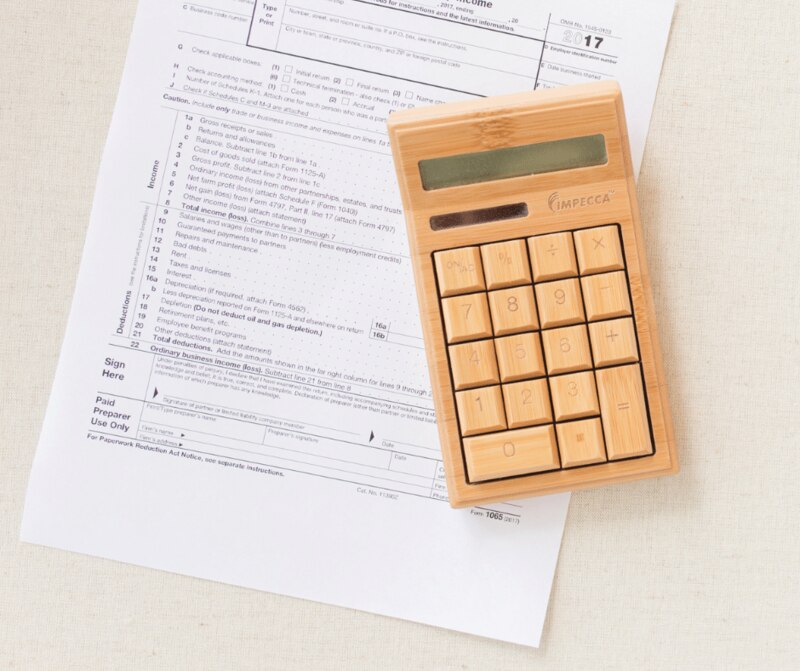

Form 4506 is a very important method for people and groups who want to get their tax records. This form, given out by the Internal Revenue Service (IRS), lets taxpayers ask for duplicates of their already submitted tax returns and all attached files such as W-2s, 1099s, or other supporting papers. When you understand the complexities of Form 4506, it helps you, a taxpayer, in getting the details that are needed for different financial and legal reasons.

Navigating the IRS System

Being familiar with the IRS system is very important to handle tax-related matters effectively. Form 4506, it's an essential part of this system that helps in getting important tax documents. Whether people need past tax returns for loan requests, immigration procedures, or legal actions, Form 4506 gives a smooth way to get these papers right from the IRS itself.

To truly comprehend the subtleties of the IRS system, it is not enough to just complete Form 4506 correctly. You must also know about other aids that can be used for help. People paying taxes can look at online guides, tutorials and frequently asked questions (FAQs) given by the IRS to clear up any confusion they have while submitting this form. Additionally, making use of tax professionals' knowledge or talking with representatives from the IRS might give a beneficial understanding and result in an easier experience.

- Online Resources: The IRS offers comprehensive online resources including guides and FAQs.

- Professional Assistance: Consulting tax professionals or IRS representatives can provide valuable insights.

Key Components of Form 4506

The Form 4506 is made up of various important parts, each serving a unique role in the process of obtaining documents. It's very crucial to comprehend these components for correctly filling out the form and assuring that you get your tax papers on time. Starting from personal details to specifying which tax years need documented proof, all sections have their importance and contribute towards completing this submission process.

Furthermore, people who pay taxes must also be cautious about the guidelines given along with Form 4506. Any mistakes or missing details might slow down its processing time so it is crucial to review everything twice before submitting.

- Instruction Review: Thoroughly reviewing the instructions accompanying Form 4506 can prevent errors.

- Information Double-Check: Double-checking all provided information minimizes the risk of processing delays.

Filing Options and Requirements

For submitting Form 4506, taxpayers have the choice to do it electronically or by traditional mail. This gives them flexibility depending on their preferences and situation. They must follow the guidelines and requirements of the IRS when requesting this form. They also need to check if all information given in their application is correct so as not to cause any delays or differences during processing time.

In deciding which way to file, people must think about how urgent it is, how easy and comfortable they find the method, as well as the simplicity of accessing necessary materials. Normally, electronic filing has a faster turnaround time. But for individuals who don't have the internet at home or face technical limitations may prefer using the traditional mail system.

- Urgency Consideration: Electronic filing often results in quicker processing times.

- Accessibility Assessment: Traditional mail may be preferable for individuals with limited internet access.

Processing and Delivery Timelines

For submitting Form 4506, taxpayers have the choice to do it electronically or by traditional mail. This gives them flexibility depending on their preferences and situation. They must follow the guidelines and requirements of the IRS when requesting this form. They also need to check if all information given in their application is correct so as not to cause any delays or differences during processing time.

In deciding which way to file, people must think about how urgent it is, how easy and comfortable they find the method, as well as the simplicity of accessing necessary materials. Normally, electronic filing has a faster turnaround time. But for individuals who don't have the internet at home or face technical limitations may prefer using the traditional mail system.

- Peak Season Awareness: Anticipating delays during peak tax seasons helps in planning.

- Early Submission: Submitting requests well in advance mitigates the risk of processing delays.

Alternatives and Considerations

Sometimes, people who pay taxes might need to get their tax documents quickly or have problems with the regular way of getting them. In these times, it becomes important for them to find other ways or ask help from experts in taxing matters. Also, they need to think about possible costs linked with requesting tax papers through Form 4506 and plan money matters accordingly so that there are no surprises in expenses.

In addition, taxpayers need to know about other ways they can get their tax information, like using online account services from the software used for preparing taxes or through a third-party vendor. These might give quicker response times or extra characteristics that make getting documents easier and faster.

- Fee Consideration: Being aware of potential fees associated with Form 4506 requests helps in budgeting.

- Alternative Methods: Exploring online account services or third-party vendors can offer faster access to tax documents.

Conclusion

Form 4506 is a fundamental tool for individuals and organizations seeking access to their tax documents. Understanding the purpose behind its necessity, the procedural intricacies involved, and the key components of this form empowers taxpayers to navigate the IRS system confidently and efficiently. Whether retrieving past tax returns for personal financial planning or business record-keeping, Form 4506 serves as a reliable avenue for accessing vital financial data. Additionally, familiarity with the form streamlines the process, ensuring smoother interactions with tax authorities and facilitating prompt resolution of inquiries. Embracing the utility of Form 4506 enhances financial transparency and accountability, contributing to a more robust financial ecosystem. Now that you have the knowledge of this valuable financial tool, use it to your advantage.