Demystifying Profit-Sharing Plans: A Comprehensive Guide for Employees

Profit-sharing plans have surged as businesses seek to motivate employees and synchronize their goals with company achievements. But what precisely are these plans, and how do they function? This guide simplifies profit-sharing, delving into its core principles, including benefits, operational mechanics, and its impact on employees.

Whether boosting morale or fostering financial security, we'll explore the intricacies of profit-sharing plans and illuminate their significance in today's workplace.

Understanding Profit-Sharing Plans:

A profit-sharing plan embodies a company's initiative to distribute a segment of its profits among its workforce. Diverging from conventional compensation models reliant on fixed salaries, profit-sharing plans allow employees to partake in the company's financial prosperity contingent upon its profitability.

Consequently, when the company excels and accrues profits, employees receive a portion of these earnings as a reward. This approach fosters a symbiotic relationship between the company and its employees, aligning their interests and incentivizing collective efforts toward achieving organizational success.

How Profit-Sharing Plans Work:

Profit-sharing plans distribute a portion of a company's profits among its employees, serving as a performance-based incentive system. Typically, these plans adhere to a predetermined formula, considering company profitability or individual/team performance.

Once profits are calculated, a portion is allocated to eligible employees, often through cash bonuses, retirement account contributions, or company stock. This mechanism fosters alignment between employees' efforts and the organization's success, enhancing motivation and engagement.

However, it's important to note that profit-sharing payouts can fluctuate based on company performance, and eligibility criteria may vary. Understanding the mechanics of profit-sharing plans empowers employees to leverage these schemes effectively, capitalizing on the opportunity for both short-term rewards and long-term financial security.

Benefits of Profit-Sharing Plans for Employees:

Profit-sharing plans offer a range of advantages for employees, contributing to their financial well-being, job satisfaction, and long-term security.

Financial Incentive:

Profit-sharing plans directly link an employee's efforts to the company's success. Employees receive a share of the profits when the company performs well, providing them a tangible financial incentive to contribute their best efforts. This boosts morale and enhances motivation and commitment to achieving common goals.

Alignment of Interests:

By tying compensation to company performance, profit-sharing plans align the interests of employees with those of the company. When employees share in the rewards of the company's success, they are more likely to feel a sense of ownership and commitment, driving them to work collaboratively towards achieving shared objectives. This alignment fosters a culture of teamwork and collective success, benefitting both employees and the organization.

Retirement Savings:

Profit-sharing contributions can significantly bolster employees' retirement savings. By allocating a portion of profits towards retirement accounts such as 401(k) plans, employees can build a robust financial safety net for their post-retirement years.

These contributions serve as an additional source of income alongside traditional retirement savings, providing employees with greater financial security and peace of mind for the future.

Employee Engagement:

Engaged employees are essential for driving organizational growth and innovation. Profit-sharing plans enhance employee engagement by fostering a sense of investment in the company's success.

When employees have a stake in the company's performance, they are likelier to demonstrate dedication, creativity, and initiative. This increased engagement contributes to a positive work environment, higher productivity, and overall business success.

Considerations for Employees

While profit-sharing plans can offer significant benefits, it's crucial for employees to understand various considerations to maximize this compensation structure.

Variable Compensation:

Profit-sharing plans tie employee compensation directly to company performance. Consequently, the amount employees receive as profit-sharing payouts can fluctuate annually based on company profitability changes. This variability underscores the importance of financial planning to manage potential income fluctuations effectively.

Eligibility Requirements:

Not all employees may qualify to participate in a company's profit-sharing plan. Eligibility criteria often hinge on factors such as job role, tenure, or employment status. Employees should familiarize themselves with these criteria to determine their eligibility and potential for participation in the plan.

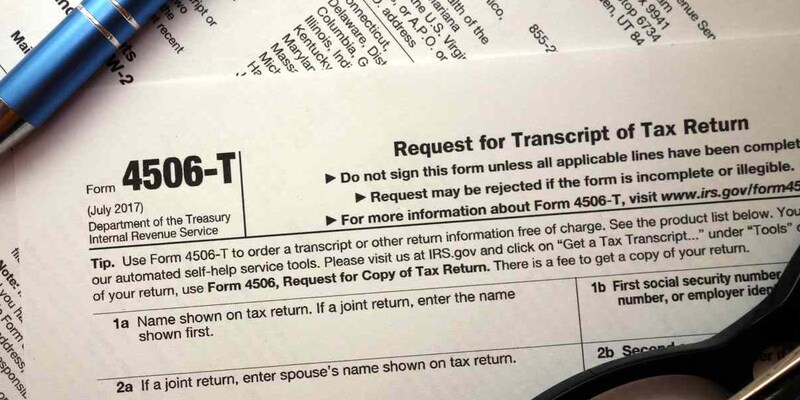

Tax Implications:

Profit-sharing distributions may carry tax implications, depending on their structure. Consulting with a tax advisor is advisable to clarify the tax treatment of profit-sharing payouts and understand how participation in the plan could impact one's financial situation. Being informed about tax obligations ensures employees can effectively plan and manage their finances.

Long-Term Planning:

While profit-sharing contributions to retirement accounts can aid in building financial security for the future, it's essential to adopt a holistic approach to long-term financial planning. Employees should assess their overarching financial goals beyond immediate profit-sharing benefits and develop a comprehensive retirement and financial well-being strategy. This proactive approach ensures that employees can maximize profit-sharing benefits while securing their financial future.

Implementing a Profit-Sharing Plan

So, how does a company implement a profit-sharing plan? The first step is determining the plan's structure. This includes deciding how profits will be calculated, how often payouts will occur, and who will be eligible to participate.

Next, clearly communicating the plan's details to employees is essential. Transparency ensures everyone understands how the plan works and what they must do to contribute to its success.

Once the plan is in place, it is essential to review and evaluate its effectiveness regularly. This includes monitoring the company's financial performance, soliciting feedback from employees, and making any necessary adjustments to the plan.

Conclusion:

In summary, profit-sharing plans are potent tools for companies to motivate employees, foster alignment with organizational goals, and cultivate enduring commitment. By granting employees a tangible stake in the company's success, these plans boost morale and motivation and fortify financial security.

However, employees must grasp the mechanics of profit-sharing, acknowledge its potential advantages and complexities, and integrate it strategically into their broader financial strategies. With comprehensive comprehension and strategic foresight, profit-sharing plans emerge as mutually beneficial arrangements, fostering symbiotic growth for employees and employers.